Just so, why is a partnership better than a private limited company?

A partnership comprises of two or more people sharing the right to make business decisions and in the net profits. They are also responsible for debts and obligations without limit. In contract private limited companies have reduced risks, as liabilities (debts) are separate from the owners.

Also, what are the main advantages and disadvantages of a partnership? Advantages and disadvantages of a partnership business

- 1 Less formal with fewer legal obligations.

- 2 Easy to get started.

- 3 Sharing the burden.

- 4 Access to knowledge, skills, experience and contacts.

- 5 Better decision-making.

- 6 Privacy.

- 7 Ownership and control are combined.

- 8 More partners, more capital.

Besides, what are the advantages of a partnership over a company?

Advantages of a partnership include that: two heads (or more) are better than one. your business is easy to establish and start-up costs are low. more capital is available for the business. you'll have greater borrowing capacity.

What are the disadvantages of private limited company?

One of the disadvantages of private limited company is that it restricts transferability of shares by its articles. In a private limited company the number of members in any case cannot exceed 50. Another disadvantage of private limited company is that it cannot issue prospectus to general public.

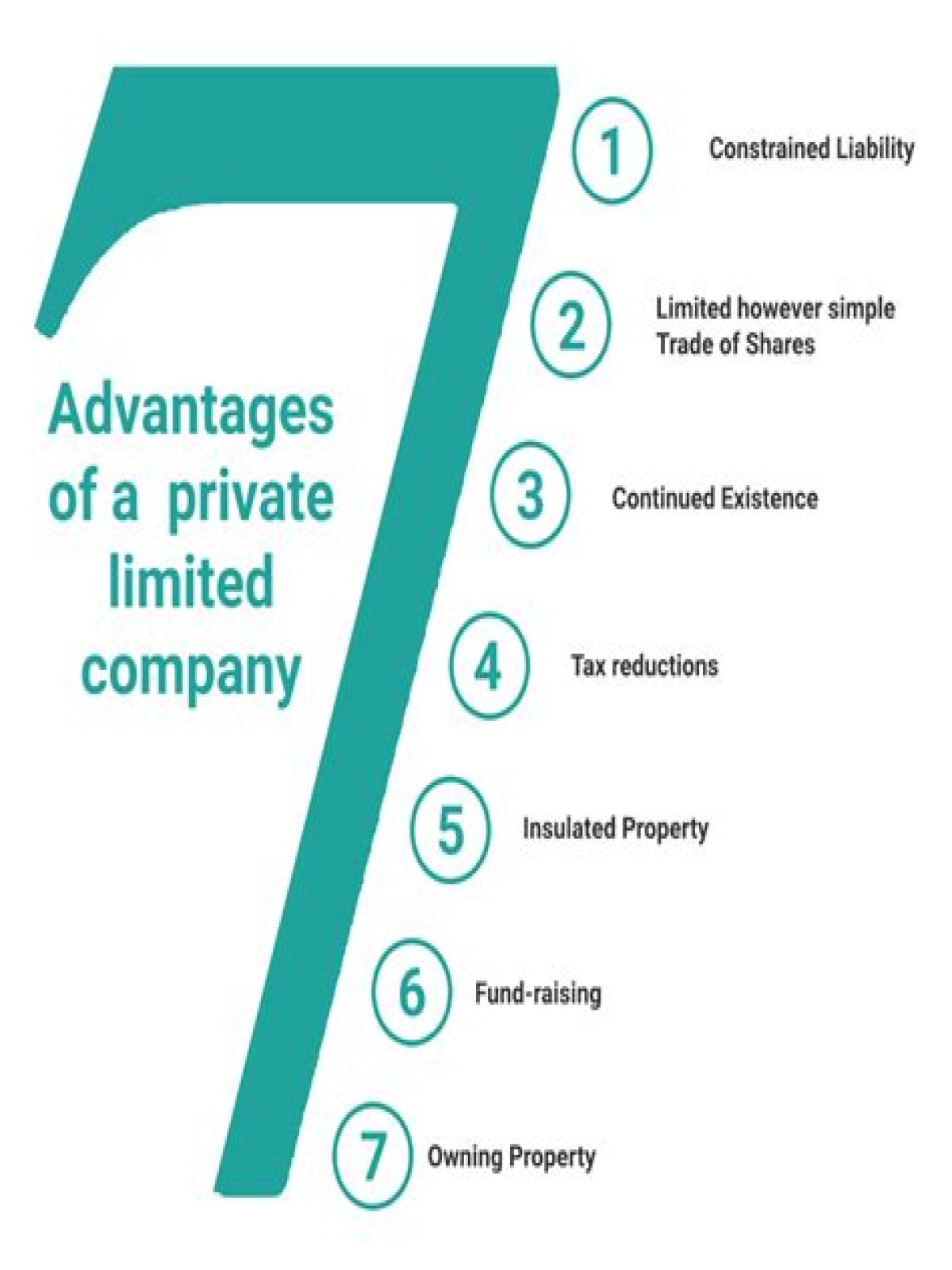

What are the advantages of private limited company?

What are the types of partnership?

Does a partnership have directors?

Is partnership Public or private?

What company is a partnership?

Is Ltd a partnership?

Which is best partnership or limited company?

| Partnership | Limited Company | |

|---|---|---|

| Remuneration | Profits/drawings | Salary/dividends |

| Taxation | Income tax | Income tax, NIC and corporation tax |

| Ownership | Partners | Shareholders |

| Management | Partners | Directors |

What are the limitations of partnership?

- (i) Uncertainty of duration:

- (ii) Risks of additional liability:

- (iii) Lack of harmony:

- (iv) Difficulty in withdrawing investment:

- (v) Lack of public confidence:

- (vi) Limited resources:

- (vii) Unlimited liability:

What are the advantages of a company?

What are some examples of partnership businesses?

- Red Bull & GoPro. One example of a partnership business is the relationship between Red Bull and GoPro.

- Sherwin-Williams & Pottery Barn.

- West Elm & Casper.

- Dr.

- Louis Vuitton & BMW.

- Spotify & Uber.

Why a partnership business is better?

Is partnership good for a business?

What are the characteristics of a partnership?

- Mutual Contribution.

- Division of Profits or Losses.

- Co-Ownership of Contributed Assets.

- Mutual Agency.

- Limited Life.

- Unlimited Liability.

- Partners' Equity Accounts.